Is Sim Racing Esports Thriving or Declining in 2025?

In the fast-evolving world of esports, sim racing—a niche that blends virtual driving simulation with competitive gaming—has always occupied a unique position. Unlike traditional esports genres such as first-person shooters or MOBAs, sim racing skills can translate directly to real-world motorsports, attracting professional drivers like Max Verstappen and fostering crossovers between digital and physical racing. As we hit mid-2025, the question looms: Is sim racing esports thriving amid technological advancements and growing markets, or is it declining in the wake of post-COVID normalization and organizational challenges? Drawing from recent events, market data, and community sentiment, the answer is nuanced—showing pockets of robust growth alongside persistent hurdles.

A Brief Background on Sim Racing Esports

Sim racing esports emerged prominently in the late 2010s with platforms like iRacing, Gran Turismo, and Assetto Corsa leading the charge. The COVID-19 pandemic supercharged its popularity in 2020-2021, as real-world races were canceled, pushing drivers and fans online. Viewership surged—sim racing hours watched on Twitch and YouTube jumped 117% between February and April 2020 alone. High-profile virtual events, such as the Le Mans Virtual Series and F1 Esports, drew millions, with prize pools reaching into the hundreds of thousands. However, as physical racing resumed, the sector faced a "normalization" phase, leading to debates about its long-term viability.

By 2025, the landscape includes established titles like iRacing and new entrants such as Le Mans Ultimate, Assetto Corsa EVO, Rennsport, and Project Motor Racing. Esports organizations, hardware manufacturers (e.g., Fanatec), and even Formula 1 teams have invested heavily, but the industry grapples with mismanagement, sponsorship fluctuations, and audience retention.

Signs of Thriving: Growth Metrics and Milestone Events

Despite some pessimism, several indicators point to a thriving sim racing esports scene in 2025. Market projections are optimistic: The global racing simulator market is expected to reach $1.24 billion by 2029, growing at a compound annual growth rate (CAGR) of 7.3%. Broader gaming simulator markets, which include sim racing, are forecasted to hit $16.17 billion by 2030 with a 13.1% CAGR, driven by esports popularity, VR/AR advancements, and rising consumer demand for immersive experiences. Hardware specifically for sim racing is booming too, with an 11.8% CAGR projected through 2031, fueled by innovations in haptic feedback, motion platforms, and affordable entry-level gear.

Event-wise, 2025 has seen standout successes. The F1 Sim Racing World Championship, featuring all 10 real F1 teams, concluded in March with Jarno Opmeer clinching his third title and Oracle Red Bull Sim Racing winning the constructors' crown. The event shattered records, peaking at nearly 79,000 viewers—making it the most-watched in the series' history—and boasted a $750,000 prize pool. Other highlights include the Gran Turismo World Series and DTM Esports on RaceRoom, which continue to attract professional teams and offer pathways to real racing opportunities. Community-driven content is exploding, with creators like @pohlracing producing high-quality videos and streamers such as @Myth_ and @summit1g grinding daily, signaling upward momentum.

Asia-Pacific leads in growth, with strong esports cultures in countries like Japan and South Korea driving hardware demand and events. North America's first Sim Racing Expo in Chicago (September 5-7, 2025) underscores expanding accessibility and fan engagement. Moreover, sim racing's role in driver development—evident in talents like Connor Zilisch transitioning to NASCAR—highlights its value to traditional motorsports.

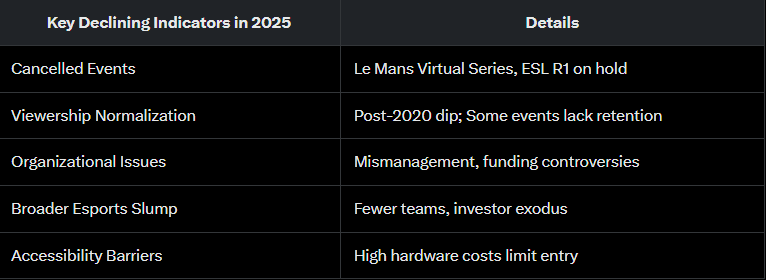

Signs of Declining: Challenges and Setbacks

On the flip side, sim racing esports isn't without red flags. Post-COVID normalization has led to a perceived decline, with viewership and participation stabilizing rather than exploding. Several high-profile series have faltered: The Le Mans Virtual Series hasn't returned since its muted 2023 season, ESL R1 remains dormant amid rumors of team pullouts, and F1 Esports faced elongated silences and condensed schedules. Mismanagement is a recurring theme—poor spectator modes in games like EA's F1 titles, controversial funding (e.g., Saudi ties in ESL R1), and financial woes at organizers like Motorsport Games have eroded trust.

Broader esports trends amplify these issues: Investor pullback post-2021 has shrunk organizations, with North American teams dropping from over 150 to under 20. Sim racing's reliance on expensive hardware (e.g., direct-drive wheels, rigs) creates barriers, and while affordable options exist, professional setups demand significant investment. Community forums like Reddit echo frustrations, labeling the scene as "struggling to stay afloat" due to fewer events and waning mainstream appeal.

Analysis: A Balanced but Evolving Landscape

Weighing the evidence, sim racing esports in 2025 appears to be stabilizing rather than outright declining, with thriving elements in market expansion and flagship events offsetting setbacks. The pandemic's artificial boost has given way to sustainable growth, particularly in hardware and technology integration (e.g., AI coaching, VR). However, to truly thrive, the sector needs better management: Streamlined event formats, improved spectator experiences, and diversified funding beyond volatile sponsorships. Community sentiment on platforms like X suggests optimism, with users noting content's upward trajectory and predicting a "golden age."

Opportunities abound—esports' global rise to a $2B+ industry (projected $6B by 2030) could elevate sim racing if it leverages crossovers with real motorsports and emerging markets like Asia. Innovations like play-to-earn models and mobile integration could broaden appeal.

Conclusion: Poised for Growth, But Not Without Effort

Sim racing esports in 2025 is neither fully thriving nor declining—it's in transition. With record-breaking events like the F1 Championship and bullish market forecasts, the foundation is solid, but challenges like event cancellations and post-pandemic adjustments demand proactive fixes. For enthusiasts, pros, and investors, the key lies in innovation, community building, and economic sustainability. As new titles launch and hardware evolves, 2025 could mark the start of a resurgence—if the industry learns from its pitfalls. Whether you're a casual racer or a competitive hopeful, the virtual track remains open, promising excitement ahead.